Stay compliant without slowing down

Compliance doesn't need to feel like a chore. With CapIntel, advisors get real-time checks and automated rules embedded into their proposal workflow. Enterprises get peace of mind without adding friction.

Compliant by default

Guide advisors with built-in checks across every proposal. From suitability questionnaires to shelf restrictions, compliance is seamlessly embedded into every step. Reduce risk and build trust by equipping advisors to recommend approved products that align with your compliance team's requirements.

Enterprise controls that scale

Configure once. Enforce everywhere. Set risk tolerances, control data access, define product alternatives, and receive material change alerts on the enterprise level. Stay compliant as your business grows, without scaling resources for monitoring.

Real-time alerts and audit trails

Track acknowledgements and prove compliance in seconds. Shelf Monitor ensures advisors are notified of material fund changes and records every acknowledgement for audit purposes. No more chasing down confirmations or relying on manual processes.

"CapIntel enhanced their platform to automate routine compliance tasks which has empowered our teams to work more efficiently and dedicate more time to delivering meaningful value to our clients."

Curtis Jenkins, President at LP Financial Services

Frictionless compliance every step of the way

Integrated compliance checkpoints exist throughout the advisor workflow, allowing your stakeholders to rest assured it is accounted for.

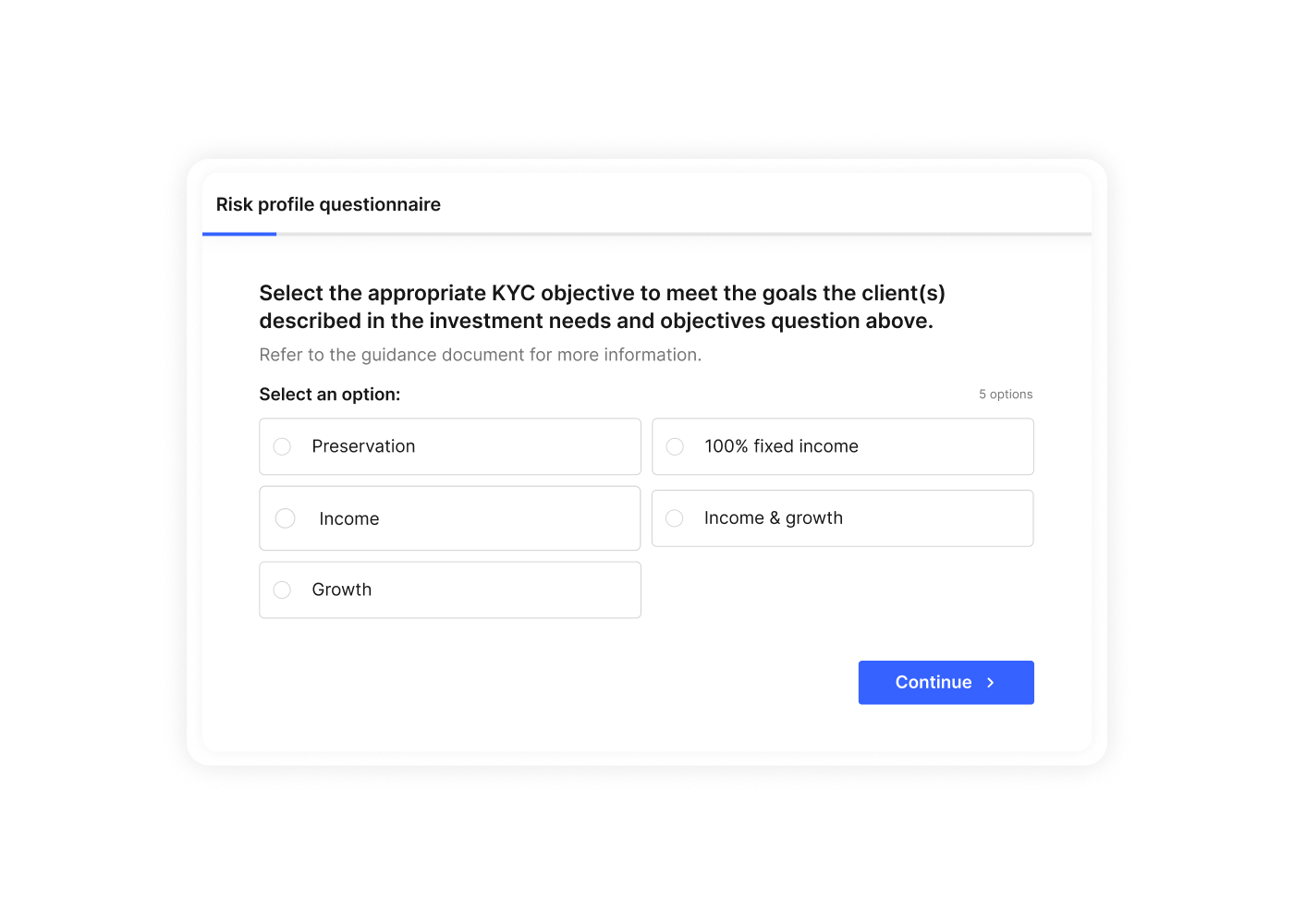

Suitability questionnaire

Capture client goals and risk tolerance with a modern KYC experience built directly into your workflow.

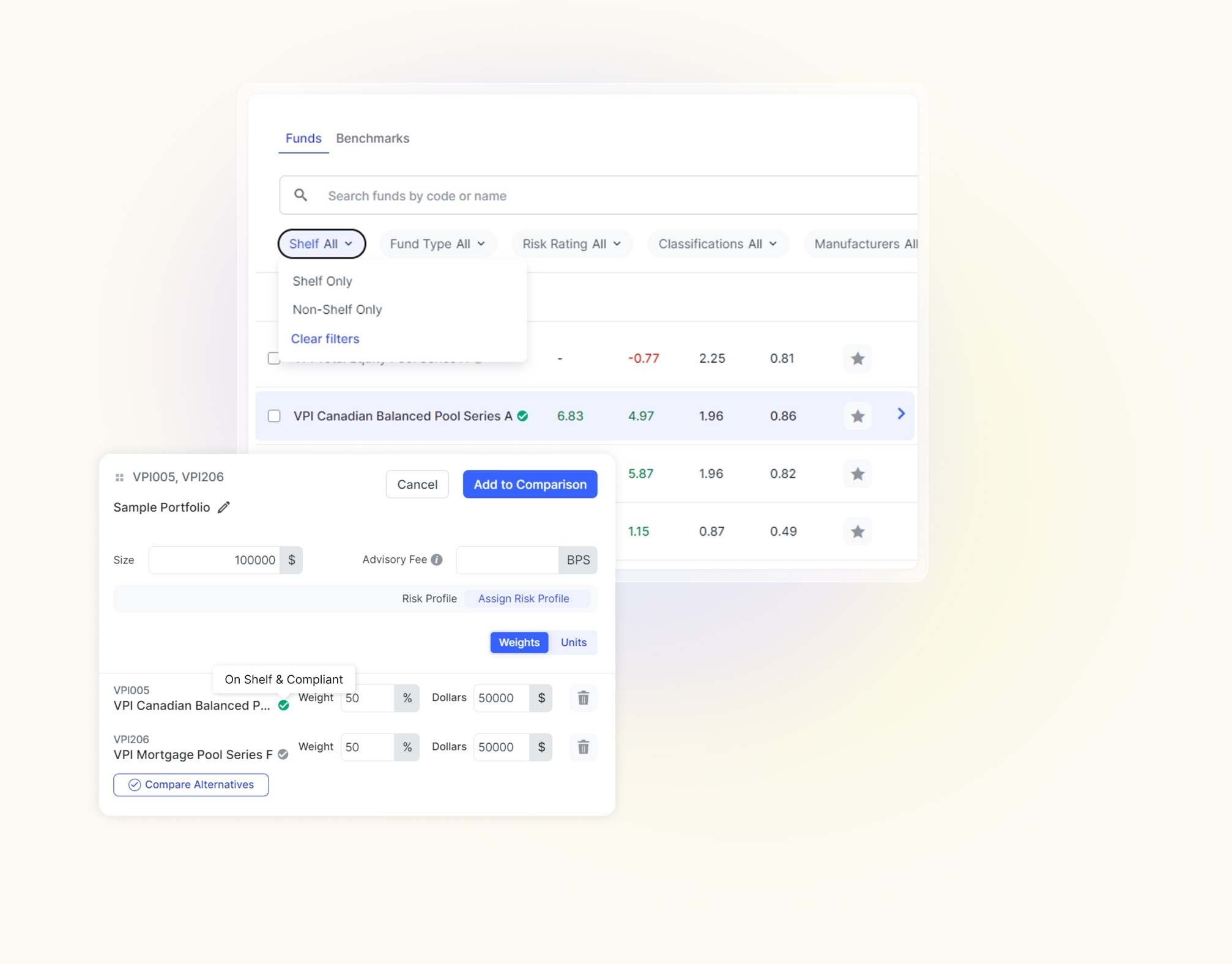

Product shelf

Give advisors visibility into which products are approved. Warn them in real time if they recommend something off-shelf.

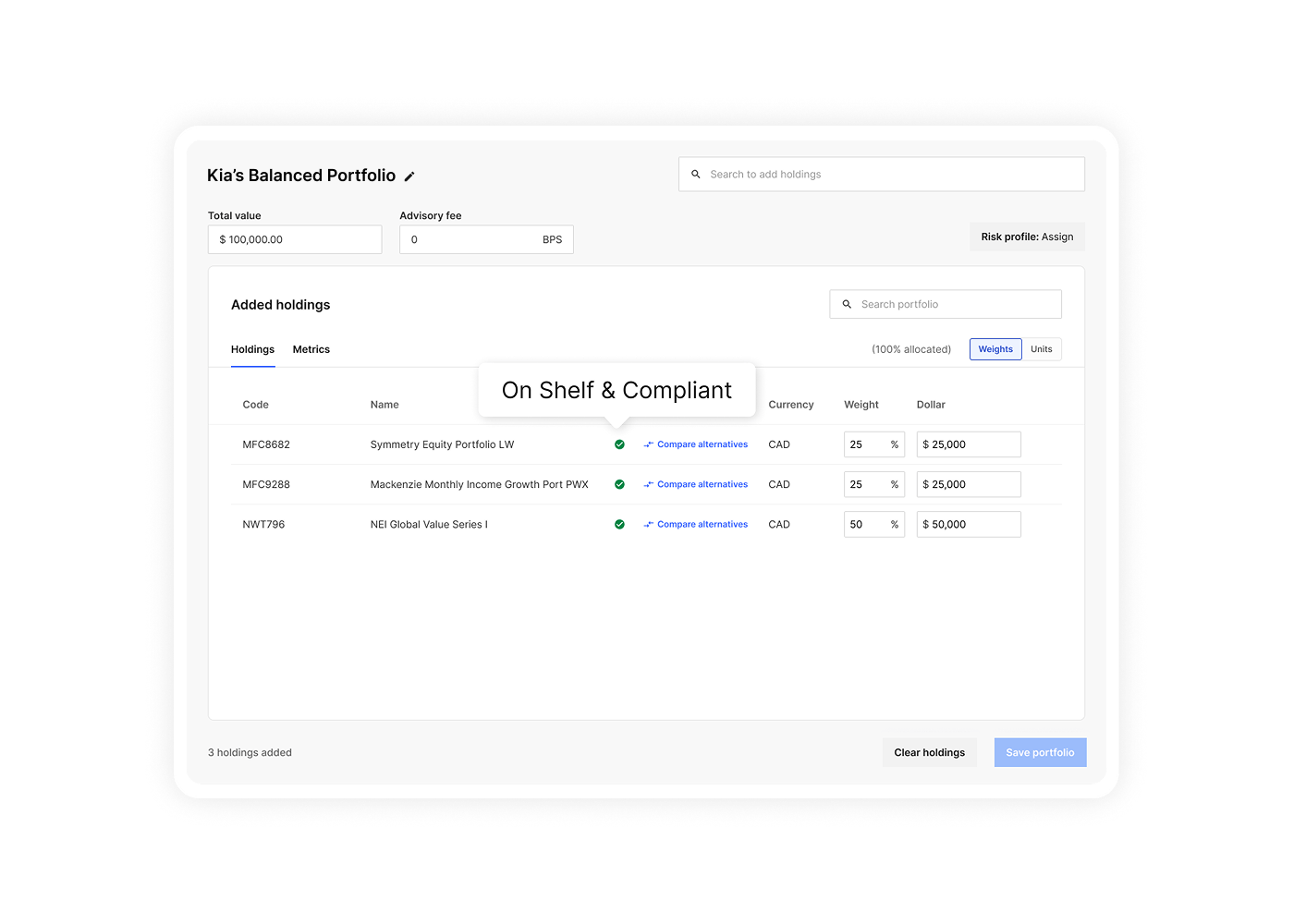

Risk profile

Ensure every portfolio recommendation aligns with your client's risk tolerance and your firm's compliance policies.

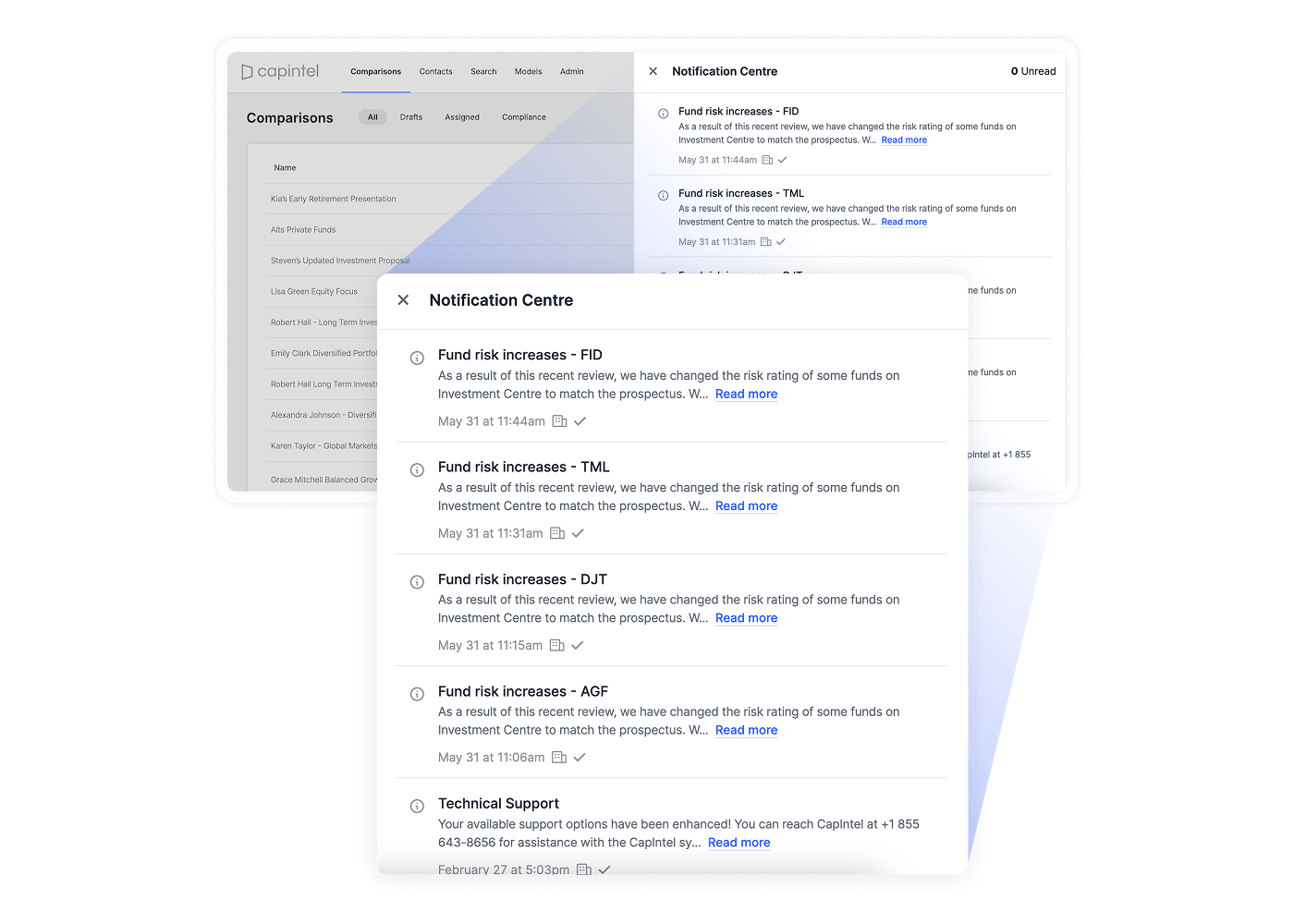

Shelf monitor

Alert advisors when material changes affect shelf products. Require acknowledgement and store a full audit trail.

Fund & model alternatives

Surface compliant fund and model options based on product type, risk, and shelf approval, no spreadsheets required.

Enterprise configuration

Centralize rules, shelf uploads, and product controls with a scalable system your compliance team can trust.

We can confidently stand in front of a regulator or client and say we have the processes, tools, and automation in place that we believe can enable us to demonstrate strong compliance. Plus, it's a great experience for advisors because it's seamlessly built into the day-to-day workflow.”

Brent Allen – EVP & Head of Strategy and Operations at IG Wealth Management

Ready to transform how you work with clients?

Most proposals confuse clients. Yours shouldn't.

CapIntel makes it easy to compare, explain, and win trust—fast.